Property deeds: What are they and how should I look after them?

Understanding property deeds

Property deeds, also known as title deeds, are legal documents that prove property ownership. In England and Wales, property registration became compulsory in 1990, meaning most ownership records are now held digitally by HM Land Registry. These deeds form part of the official record of who owns a property and the land it sits on.

What do property deeds include?

Property deeds record:

- The owner’s name and date of ownership transfer.

- Legal boundaries of the property and any attached land.

- Details of mortgages, leases, easements, or covenants affecting the property.

- When a property is first registered, HM Land Registry scans the original deeds and returns them to the submitting solicitor or conveyancer. This electronic version becomes the official title record.

Register today! Be amongst the first to see new and off-market homes for sale in your area.

Are there different rules across the UK?

Yes. HM Land Registry manages property records only in England and Wales.

- In Scotland, records are held by Registers of Scotland.

- In Northern Ireland, by Land and Property Services.

Buyers and sellers must ensure they contact the correct authority for their region.

What do property deeds look like?

Modern title deeds are typically digital documents, though older properties may still have original paper versions. Unless your home has never been registered before, you are unlikely to hold the original deeds.

Your solicitor should provide a copy of the registered title within a few weeks of completion. You can also search for your property’s title number and order an official copy online through HM Land Registry.

Do I need property deeds to sell my house?

If your property is registered, you do not need original deeds to prove ownership. HM Land Registry’s database is the definitive record used in sales and conveyancing.

However, keeping a copy of the original deeds can still be helpful, especially for information on:

- Historic ownership.

- Legal boundaries or shared access rights.

If your property was previously registered, the original deeds may remain with your solicitor or mortgage lender.

How much do the Land Registry charge?

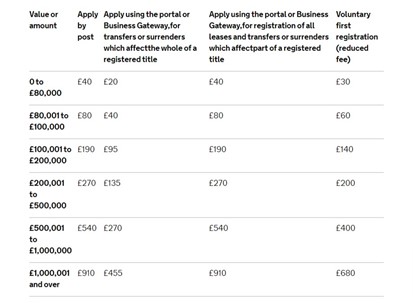

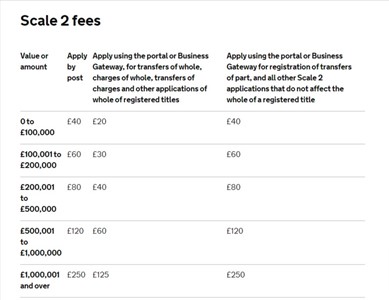

Applications to the Land Registry have two different scales for fees which depend on the type of transaction, for example, a first registration is different to a transfer of the share in a property. Below are the details of these scales, but the exact costs for your property will be discussed with your solicitor.

You can find full details of the fees at gov.uk

Where should I keep my property deeds?

Because HM Land Registry stores digital copies securely, losing your personal copy is not a legal issue. Still, it’s best to keep your documents organised:

- Store them with other key financial records.

- Keep them in a labelled, weatherproof folder or cabinet.

- Consider scanning and saving an encrypted digital copy for convenience.

What if I lose my property deeds?

If your property is unregistered and you lose the original deeds, contact the solicitor who handled your purchase. They can submit a deeds request to HM Land Registry on your behalf.You’ll need to pay a small administrative fee. If the original documents cannot be found, you may be asked to provide evidence of ownership, such as historical records, mortgage statements, or utility bills linked to the address.

Thinking of buying a property?

We make it our mission to get you moved. haart’s Buying Process is our useful guide packed full of the steps and responsibilities for a buyer, as well as hints and tips to make the process as stress-free as possible.

Do remember if you are buying or selling with us, our phone lines are open from 8am-10pm, seven days a week to ensure we are there for you every step of the way. If you prefer to speak to someone in person – just find the local branch to you, check their opening hours and pop in to see them – they will be glad to help you.